Beyond the Shadow of Exports: Demystifying the Indian Diagnostics Landscape with a Financial Lens

While headlines often spotlight the booming Indian healthcare sector, a crucial segment quietly navigates cyclical tides – diagnostics. Despite its vital role in disease detection and treatment, the past three years have witnessed a complex interplay of consolidation, ignored potential, and an outlier performer in the diagnostics space. This begs the question: is it time to reconsider the narrative and recognize hidden gems within the industry based on their financial and fundamental aspects?

A Tale of Two Worlds

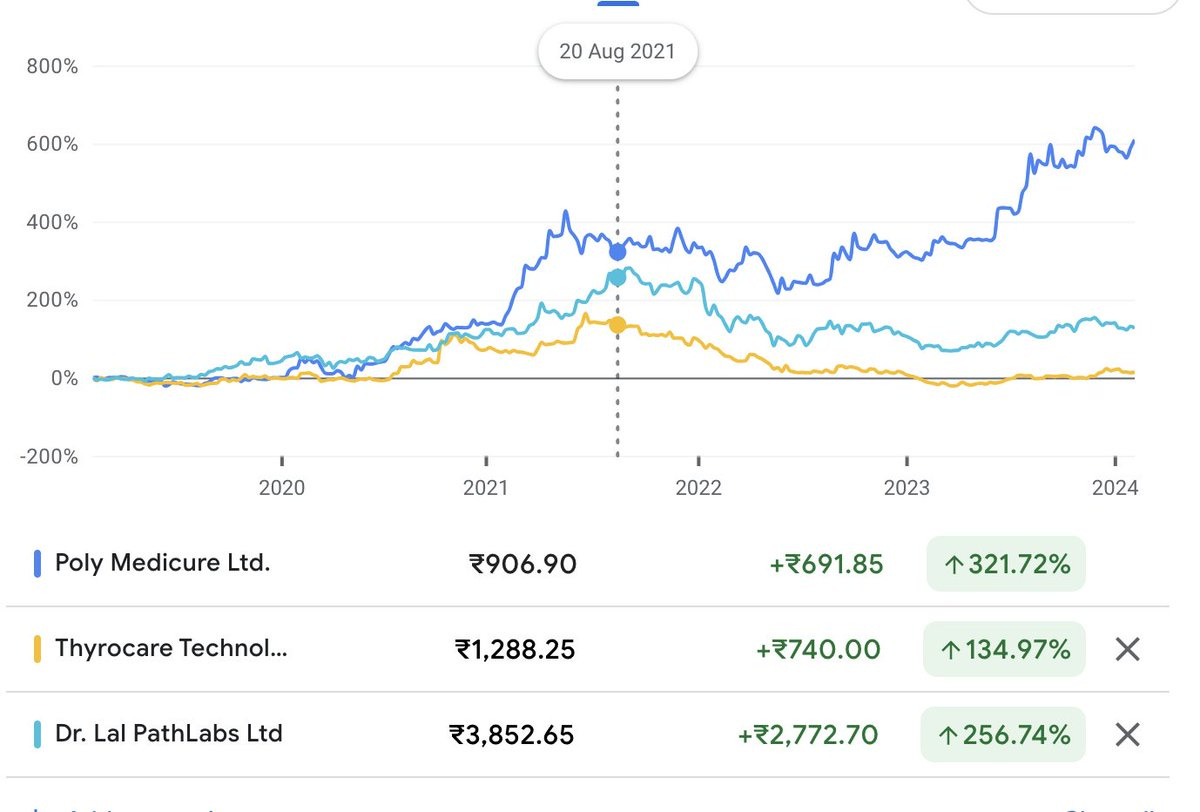

On the surface, the Indian diagnostics industry exhibits impressive growth, driven by factors like rising disposable incomes and awareness of preventive healthcare. However, beneath the shiny facade lies a nuanced reality. While some, like Polymed Healthcare, with its diversified export focus (over 60% revenue abroad), have thrived, others like Dr. Lal PathLabs and Thyrocare Technologies haven't enjoyed the same sunshine. Their dependence on the domestic market exposes them to economic fluctuations and intense competition, resulting in stock prices trading significantly lower than their 2021 highs.

Consolidation's Double-Edged Sword:

The industry has witnessed significant consolidation in recent years, with larger players acquiring smaller ones. This has led to economies of scale, improved technology adoption, and wider reach. However, it has also raised concerns about increased concentration and potential price hikes, impacting affordability and accessibility.

Polymed's Gambit:

Polymed's export-driven strategy has proven to be a key differentiator. Diversifying revenue streams across international markets shielded them from the cyclical nature of the domestic market and currency fluctuations. Additionally, their focus on diagnostic imaging, a segment less prone to discretionary spending, further bolstered their resilience

Financial and Fundamental Analysis:

Let's delve deeper into the financial and fundamental aspects of each company:

Polymed Healthcare: They boast a healthy revenue growth rate (CAGR of 18% over the past 5 years) and a strong EBITDA margin (25% in FY23). Their focus on emerging markets with high growth potential positions them well for future expansion. However, their dependence on a few large clients and geopolitical risks in key markets are potential concerns.

Dr. Lal PathLabs: Despite a dominant market position (23% market share in pathology), Lalpathlabs' revenue growth has been muted (CAGR of 6% over the past 5 years), and margins have been under pressure due to competition and price wars. However, their recent focus on cost optimization, network expansion, and new service offerings like genetic testing could be potential growth drivers.

Thyrocare Technologies: The undisputed leader in thyroid testing, Thyrocare also exhibits stable revenue growth (CAGR of 12% over the past 5 years) and healthy margins (20% in FY23). They are leveraging technology effectively and expanding their service portfolio beyond thyroid testing. However, their over-reliance on the single specialty and increasing competition in the diagnostics space pose challenges

Consolidation continues, companies like Lalpathlabs and Thyrocare, with their inherent strengths, potential for strategic adaptation, and improving financial fundamentals, could emerge as the next wave of growth stories with its ability to serve the diverse healthcare needs of the Indian population.

Here’s why it might be time for Lal Path Labs to shine again

Keep reading with a 7-day free trial

Subscribe to Craving Alpha to keep reading this post and get 7 days of free access to the full post archives.