CravingAlpha Chronicles: This under owned PSU stock clocked 25% in a month

Engineers India Limited has been a part of our Future Leaders Portfolio and has generated a neat 25% for our clients, read on to know why we think it's still a good stock!

Engineers India’s stock has seen a solid one way move in the past month surging from 115 to 146 or 25%

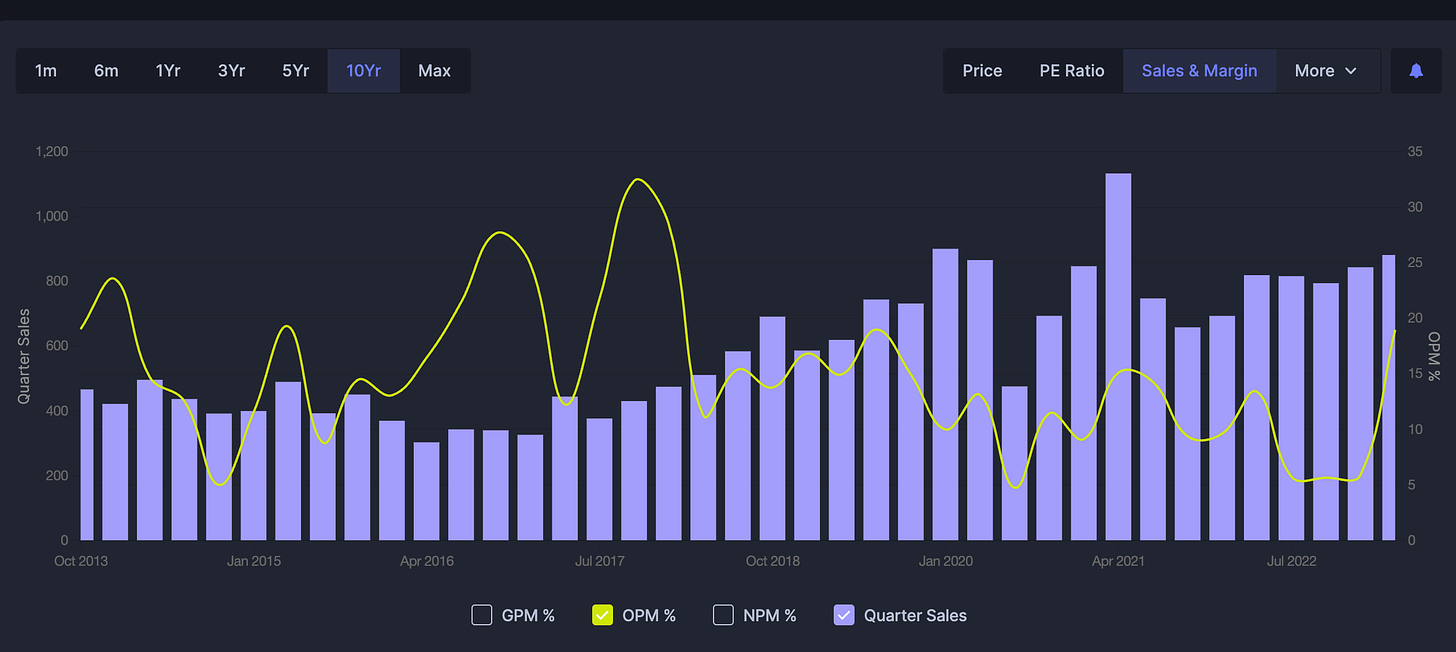

In recent years, EIL has been on a turnaround. The company has improved its operational efficiency and financial performance. It has also won a number of major contracts, including the Barmer oilfield development project in Rajasthan and the Dabhol power project in Maharashtra.

The company is a government owned EPC with exposure to projects in developing markets like Nigeria and Mongolia.

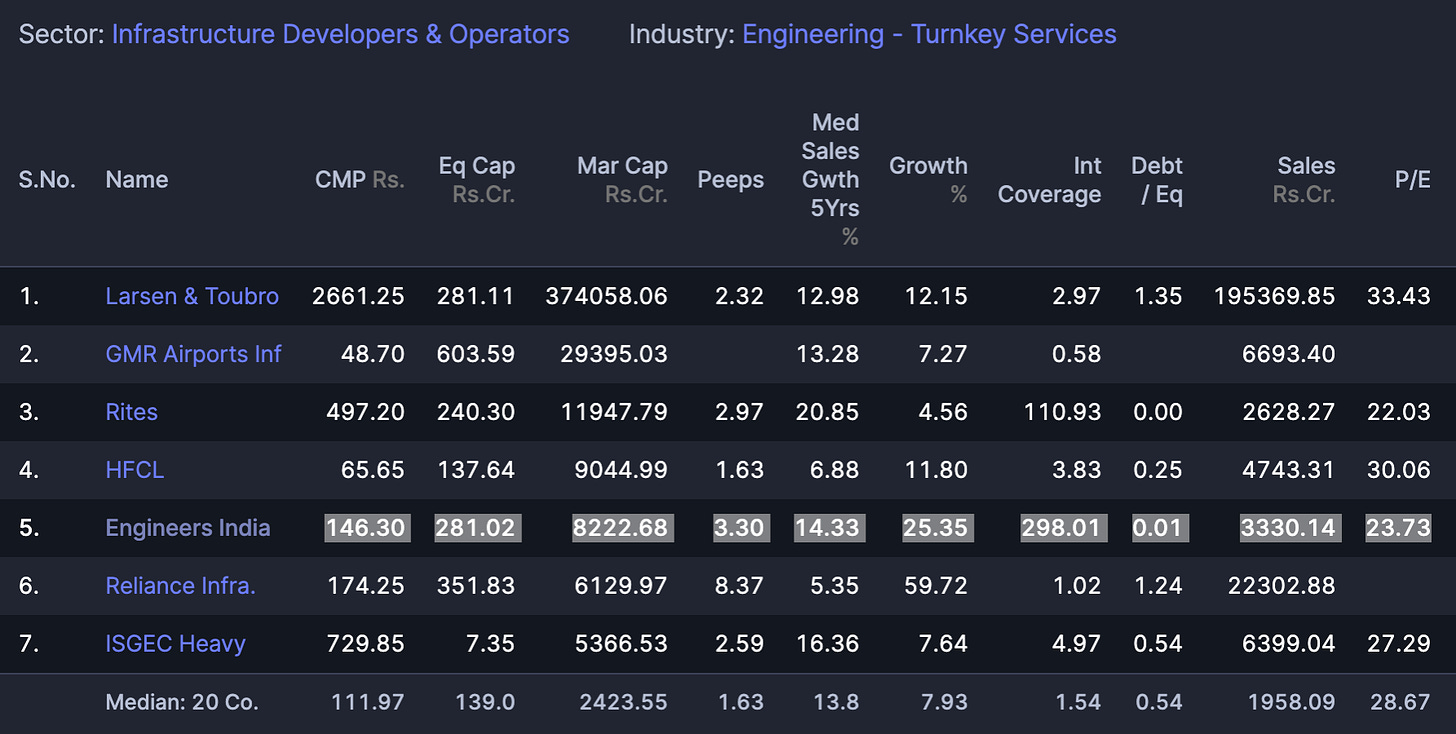

Compared to it’s larger peers, they have the highest growth rate of 25.35% with the lowest debt and to make things better they are trading at a 23.73x PE (even after the staggering 25%) up move.

However, though the business was cyclical in the past, we believe the future has immense scope for the company and the valuation comfort helps us build conviction.

The company is well-positioned to benefit from the growing demand for EPC services in India. The Indian government is investing heavily in infrastructure, and EIL is one of the few companies with the experience and track record to deliver these projects.

Disc: We have an exposure to this stock through our Future Leaders portfolio, please do not construe this post as an advertisement for the same

Thank you for your time and consideration.