In the dynamic world of stock markets, where uncertainties and fluctuations are the norm, identifying opportunities for potential gains is crucial for investors. One such opportunity lies in the historical performance of the Nifty index during the April to December period over the past 16 years. Remarkably, the Nifty has only clocked negative returns in this period thrice, highlighting a compelling opportunity for investors to capitalize on market dips.

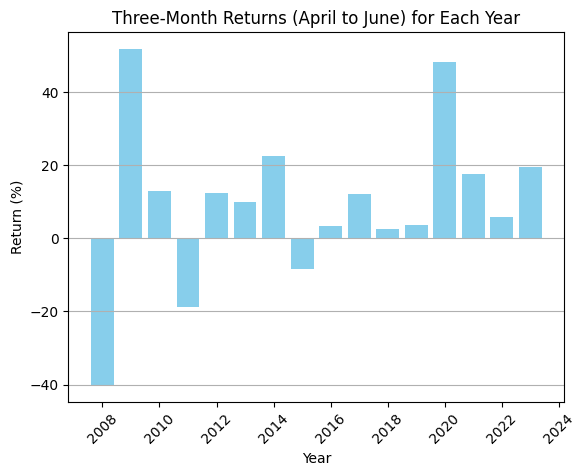

Let's delve into the data: over the past 16 years, the Nifty index has displayed resilience and robustness, delivering positive returns for the April to December period in most years. In fact, out of these 16 years, the Nifty posted negative returns only in 2008, 2011, and 2015. Despite these occasional downturns, the overall trend underscores the index's ability to bounce back and generate wealth for investors.

The data speaks volumes: in 2008, amidst the global financial crisis, the Nifty witnessed a significant downturn, registering a staggering -40.16% return for the April to December period. However, this downturn was followed by a strong recovery in subsequent years, with the index rebounding and delivering impressive gains in 2009 and beyond.

Similarly, in 2011 and 2015, the Nifty experienced temporary setbacks, posting negative returns of -18.79% and -8.30%, respectively, during the April to December period. Yet, these downturns were short-lived, as the index quickly recovered and resumed its upward trajectory in the subsequent years.

What does this mean for investors? The historical resilience of the Nifty during the April to December period presents a compelling opportunity for investors to capitalize on market dips and volatility. By strategically allocating funds during these periods of temporary weakness, investors can potentially benefit from the market's inherent tendency to rebound and generate wealth over the long term.

Moreover, the data underscores the importance of adopting a disciplined and patient approach to investing. Instead of succumbing to market volatility and panic-selling during downturns, investors can take advantage of lower valuations to accumulate quality stocks at attractive prices, thereby positioning themselves for future growth and wealth creation.

It's essential to remember that investing in the stock market carries inherent risks, and past performance is not indicative of future results. However, by staying informed, maintaining a long-term perspective, and seizing opportunities presented by market downturns, investors can navigate through volatility and strive towards their financial goals.