The Strategic Rise of Bharat Electronics Limited (BEL)

and how this has been the top performing stock in our Sector Advantage

Introduction

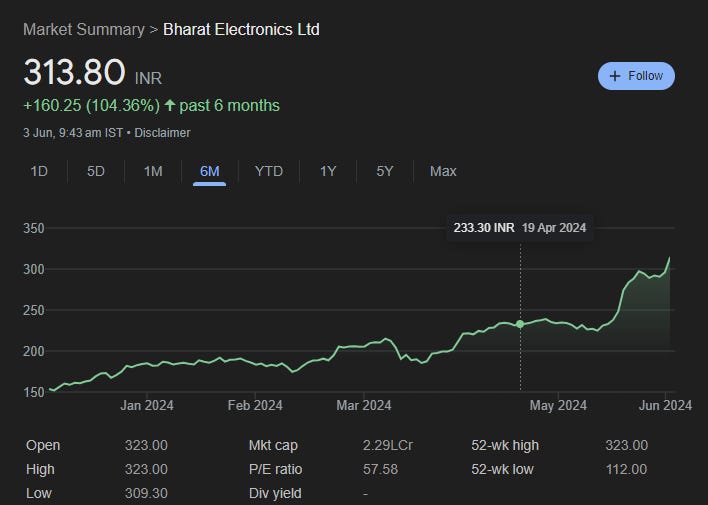

In the dynamic world of stock markets, certain opportunities arise that align perfectly with a well-researched and strategically diversified portfolio. One such opportunity is Bharat Electronics Limited (BEL), a premier Indian aerospace and defense electronics company. In this blog post, we delve into BEL's impressive growth, the factors driving its success, and how our portfolio strategically capitalized on its potential, buying in at ₹190 and witnessing a surge to ₹315 within just two months.

Understanding BEL: A Legacy of Excellence

Established in 1954, Bharat Electronics Limited (BEL) is a Navratna PSU under the Ministry of Defence, Government of India. It has been a cornerstone in India's defense sector, known for manufacturing advanced electronic products for the Indian Armed Forces. Over the decades, BEL has diversified its portfolio to include products for civilian applications, showcasing its robust R&D capabilities and innovative prowess.

BEL's product range spans radar systems, communication equipment, electronic voting machines, and more. Its strategic collaborations and partnerships have bolstered its market position, making it a key player in both domestic and international markets.

Our Strategic Pick: Why BEL?

Strong Fundamentals and Financial Performance

Our investment strategy is rooted in thorough analysis and research. BEL's consistent financial performance, healthy order book, and strong balance sheet made it an attractive candidate. The company has demonstrated resilience with steady revenue growth and robust profit margins, even amidst market volatilities.

Robust Order Pipeline

BEL’s strong order pipeline, primarily from the defense sector, is a testament to its industry leadership. The government's push for indigenization and self-reliance in defense has significantly benefited BEL. The company’s ability to secure substantial orders consistently has been a key driver of its growth.

Strategic Diversification and Innovation

BEL’s ventures into non-defense sectors such as homeland security, smart cities, and e-governance projects underscore its strategic diversification. The company's commitment to innovation, with a focus on R&D, positions it well for future growth.

Government Initiatives and Support

The Indian government's emphasis on 'Make in India' and increased defense spending has created a conducive environment for BEL. Policy support, coupled with initiatives like Atmanirbhar Bharat, have reinforced BEL's market position and growth prospects.

The Investment Journey: From ₹190 to ₹315

Keep reading with a 7-day free trial

Subscribe to Craving Alpha to keep reading this post and get 7 days of free access to the full post archives.