India’s Expensive Markets Face FII Outflows Amid U.S. Election Results: What’s Next for Investors?

In recent years, India’s equity markets have seen a tremendous rally, making them one of the most expensive among emerging markets. Foreign Institutional Investors (FIIs) have driven much of this growth, as India presented an attractive destination for international capital. However, the recent U.S. election outcome, with Donald Trump’s strong performance, signals potential shifts in global capital flows. As money increasingly flows back to the U.S. in light of expected economic policies, India’s markets are already witnessing a significant retreat by FIIs—a trend likely to continue in the coming months.

The Rally that Made India Expensive

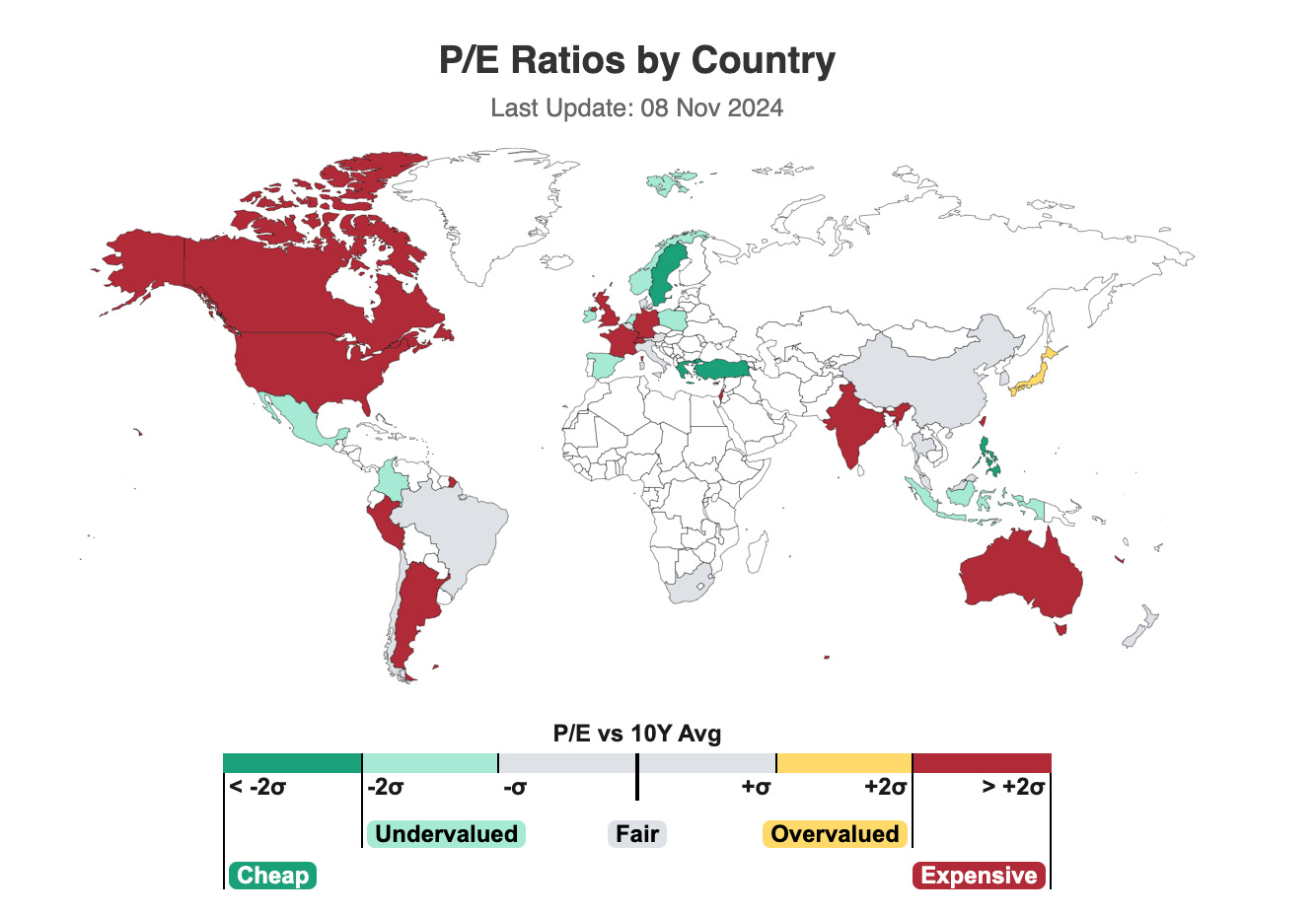

The past few years have been exceptionally bullish for India. The sustained rally has taken Indian markets to valuations that now stand significantly higher than most other emerging markets, as well as beyond historical averages. Factors such as economic recovery post-pandemic, tech sector growth, and strong retail investor participation have all contributed to this meteoric rise. However, this upward movement has left India trading at a premium compared to its peers, signaling potential risks of overheating

As valuations climbed, we had shared a note with our investors, advising caution about the rising expense of Indian markets.

In our analysis, we stressed that it might be prudent to consider taking some profits off the table as valuations had stretched significantly. Our anticipation of a possible cooling-off period seems to be materializing as FIIs recently accelerated their sell-offs, leading to a sharp correction in several high-flying stocks.

U.S. Policy Shifts and Implications for India

The recent U.S. election results are anticipated to shape global capital flows in ways that could further impact emerging markets like India. Trump’s anticipated economic policies, which focus on strengthening the U.S. economy, could bring an influx of capital back to the U.S. With expectations of tax cuts, infrastructure spending, and pro-business regulatory reforms, global investors may find the U.S. markets more appealing than emerging markets, leading to a shift in fund allocation.

For India, this means that FII outflows could persist, if not intensify, in the short term. Over the last month, India has already seen substantial foreign selling, driven by both the need for profit-booking and emerging uncertainties. The continued dollar strength and potentially higher yields in the U.S. add another layer of pressure, as these make U.S. assets more attractive relative to emerging markets.

Stock Selection as a Key for Alpha Generation

While the ongoing correction may appear worrisome, we believe there is still a case for long-term growth and alpha generation in Indian equities. In an environment where broad indices may not exhibit the kind of exuberant growth we have become used to, there is an opportunity to generate alpha through a selective approach. We are moving away from the broad rally phase and entering a period where stock-specific factors will likely play a more substantial role in investment returns.

Going forward, robust stock selection will be crucial, focusing on companies with strong fundamentals, unique market positions, and resilient growth prospects. This shift in strategy might require more active management and diligence, but it could open up avenues for outperforming the broader market even amid a period of consolidation and heightened volatility.

Final Thoughts

In summary, India’s markets are facing headwinds, with FIIs recalibrating their exposure amidst high valuations and shifting global financial trends. The correction may continue, but we see this as a healthy adjustment that could pave the way for a more sustainable growth trajectory. For our investors, this environment highlights the importance of strategic rebalancing and a selective approach. With prudent stock selection, we believe there is potential to generate meaningful returns even in a changing landscape.